Digikolo is known to be a mobile Savings application established by Digital Space Capital with the sole aim of promoting and encouraging excellent and organized saving tradition for individuals who have set up financial goals, with accrued interest rate of up to 13.5% Per Annum.

Interestingly, DigiKolo App was launched in 2021 with over 5,000 downloads so far, to help deepen financial inclusion in Nigeria.

DigiKolo Interest Rate For Users 2023

The savings platform offers the opportunity to achieve even more with savings which could be through Normal Saving, Target savings, as well as fund locking for a choice period of time with a high interest rate of 13.5% flat, and up to 18% promotional interest rate.

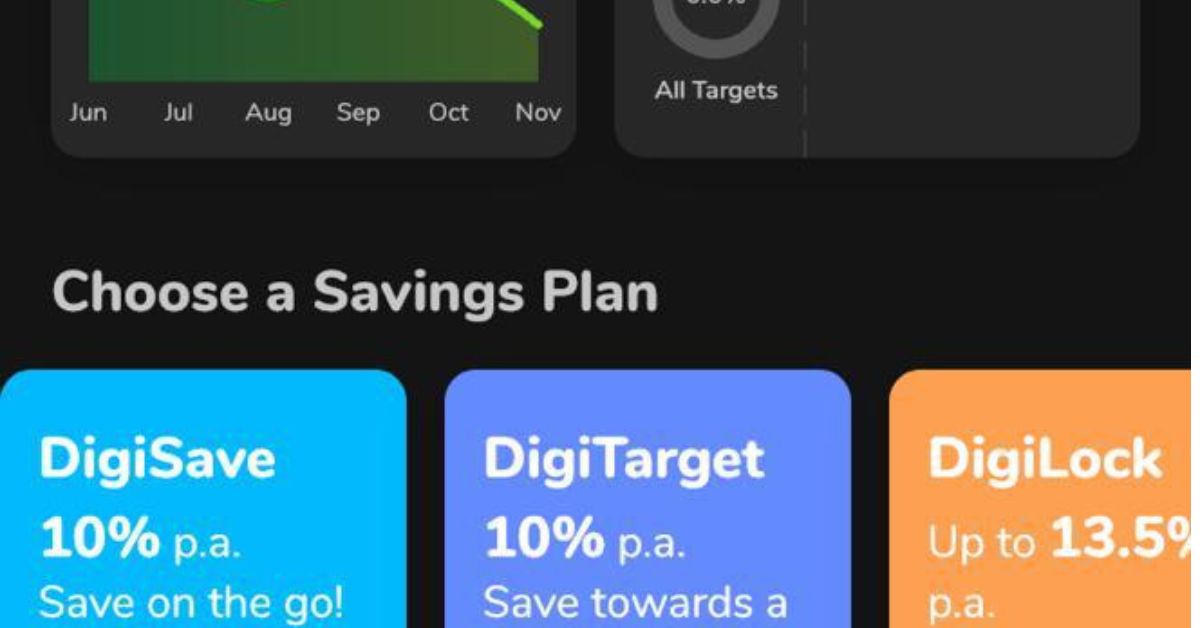

3 Distinctive Savings Plans of DigiKolo

DigiSave

DigiSave is a normal savings platform for individuals who are interested in attaining unimaginable financial height through normal savings with a 10% interest rate per annum.

For DigiSave, you have a 3 months withdrawal window interval where you can withdraw your money without charges. However, you will be charge a penalty fee of 1.75% of the withdrawn amount for making withdrawals outside the cash out windows

Steps to save on DigiSave

- Download the app from google play store (for android users) or App Store (for iphone users)

- Log into your already downloaded digikolo App with your password

- Choose DigiSave from the savings plan

- Click on ‘’Quick Save’’

- Enter amount to be saved

- Choose the payment source

- Click ‘’Save’’

DigiTarget

This savings plan enables you to make savings towards a targeted goal such as rent, school fees, wedding, vacation, travel, birthday, emergency etc. for a fixed period of time with accrued interest rate of 10% per annum.

Meanwhile, you shall not be entitled to any interest on your DigiTarget if the targeted interest is broken.

Steps to save on DigiTarget

- Log into the DigiKolo App with your password

- Choose DigiTarget from the savings plan

- Enter Savings Name, Target Amount and End Date

- Choose Savings Plan

- Select Category

- Automate this DigiTaget (optional)

- Tick the box to agree on the savings terms

- Click ‘’Next’’

- Click ‘’Pay & Create DigiTarget’’

DigiLock

This plan avails you the opportunity to lock your savings for a choice period of time for a dedicated project, or to achieve a long term goal with a return of 13.5% interest rate per annum.

Nevertheless, the DigiLock interest rate can be received upfront or on maturity, depending on what you want.

Unlike DigiSave and DigiTarget that can be broken with a penalty of 1.75% of the amount to be withdrawn,Digilock savings cannot be broken until maturity.

Steps to Lock your Funds on DigiLock

- Log into your already downloaded DigiKolo App with your password

- Choose DigiLock from the sayings Plan

- Enter Savings Name, Amount To Lock and Number of Days

- Choose when to receive your interest

- Choose a category

- Choose Payment source

- Tick the box to agree on the savings term

- Click ‘’next’’

- Click ‘’Pay & Create DigiLock

How Often Can One Save?

Savings can be done manually or automated daily, weekly or monthly, depending on the income of the individual, and can be made through transfer, Debit Card, DigiWallet and My virtual Account.

What is DigiWallet?

DigiWallet is a platform in DigiKolo where the accrued interest is transfered to, at the end of every month. Moreover, DigiWallet can also be funded via Transfer, Debit Card and Virtual Account.